If you’re looking for a smarter way to find trade ideas — one that doesn’t require hours of research — start by following the people who know their companies best: the insiders.

When CEOs, CFOs, and directors use their own money to buy shares, they’re signaling absolute confidence. And because these transactions are public through SEC filings, you can track them legally and use the data to your advantage.

At Insider Trading Alerts, we scan thousands of filings each day to highlight insider stock buys that have historically led to substantial returns. This month, five trades stood out for their exceptional timing, conviction, and proven track records. Let’s take a closer look at what insiders are buying, and why these moves caught our attention.

1. AMD – Insiders Step In After a Pullback

AMD (NASDAQ: AMD) has been under pressure recently, giving up some of its earlier gains. But just as sentiment cooled, several company insiders started buying again — a move that often signals long-term confidence in where the stock’s headed.

If you’ve been watching AMD’s chart and wondering whether the pullback could be a buying opportunity, insider activity is sending a clear message. These trades often appear near local lows, right before a rebound.

Take a look at how insiders have timed AMD’s performance over the past six months:

Insider Trading Alerts’ data shows AMD has a strong record of positive next-day returns following clusters of insider buys, especially after periods of weakness. That suggests insiders may be positioning themselves ahead of upcoming catalysts, such as earnings or new product launches.

For traders who monitor the stocks insiders are buying, AMD’s recent activity is a strong indication that confidence is growing again.

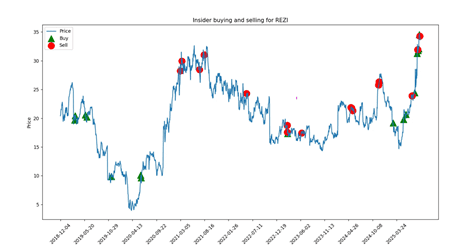

2. REZI – A Quiet Performer with a Strong Insider Track Record

Resideo Technologies (NYSE: REZI) may not make headlines, but its insiders have quietly built one of the most consistent track records in the market. When the stock traded around $22 earlier this year, they began buying heavily, and since then, it has climbed to about $33, a gain of roughly 50%.

If you’re the type who prefers steady, data-backed trades over hype, REZI’s insider history is hard to ignore. Their timing has been remarkably consistent over the years.

Here’s a look at how insider activity has performed over time:

Back tests from Insider Trading Alerts show that following insider purchases at REZI could’ve led to a 17x return since 2018. And now, insiders are buying at even higher levels than before — a clear sign their conviction hasn’t faded.

If you’re looking for stocks insiders are buying with a proven edge, REZI deserves a spot on your radar.

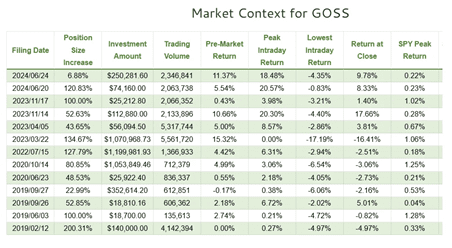

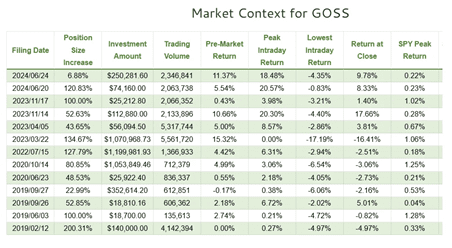

3. GOSS – Fast-Moving Setup with Strong Historical Edge

If you like fast-moving setups backed by data, Gossamer Bio (NASDAQ: GOSS) is worth a closer look. This stock has developed a pattern that traders love — 13 tracked insider trades, each averaging about 7% gains within a day of the filings.

That kind of quick reaction makes GOSS a favorite among traders who like fast setups. With a lower share price and higher volatility, the market often responds strongly when new insider buys hit the tape. If you’re looking for short-term opportunities with clear data behind them, GOSS fits that mold perfectly.

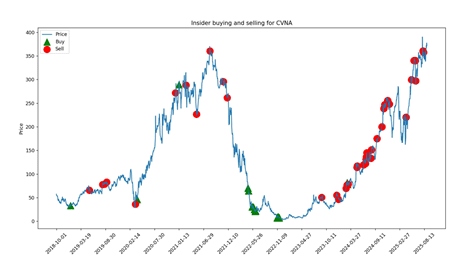

4. CVNA – Conviction Buys That Paid Off Big

Carvana (NYSE: CVNA) has staged one of the market’s most dramatic comebacks — and insiders were buying long before the crowd noticed. After a brutal decline that pushed shares into single digits, executives stepped in with purchases in the $6–$10 range, spending millions of their own money.

Those trades turned out to be incredibly well-timed: insiders saw returns as high as 62 times, and total holdings rose by more than 17,000%. Even today, insider activity remains strong, signaling ongoing confidence in the company’s turnaround.

For anyone tracking insider stock buys, CVNA is a prime example of how patience and conviction from insiders can translate into significant market opportunities.

5. OPEN – Insider Confidence Amid Retail Hype

Opendoor Technologies (NASDAQ: OPEN) has been making headlines on social media, but recent insider moves have made the story even more interesting. The CEO just purchased 30,000 shares, worth roughly $120,000 — a modest addition, but one made alongside the cancellation of a 10b5-1 selling plan.

Here’s a look at the official SEC filing confirming the purchase:

That combination signals belief in the company’s direction, even as retail buzz pushes the stock higher. It’s a reminder that even smaller insider purchases can validate momentum when you track the stocks insiders are buying and see how they align with bigger market themes.

Ready to Spot the Insider Stock Buys That Could Move the Market?

You don’t need a research team to see where insider confidence is building — you just need the correct data. Insider Trading Alerts makes it easy with daily, ranked alerts that show the most significant insider stock buys, complete with performance data and historical back tests.

Each alert tells you:

- Which insiders are buying

- How large their purchases are

- How similar trades performed in the past

Take a data-driven approach to trading and stay ahead of potential market moves. Start your free trial today and see the next wave of insider buying before the market reacts.