One question we often get is “how do I get in on the opening price of a stock?” The insider trading alerts strategy is designed to take advantage of initial buying pressure for a stock due to insider trading filings, and one key part of taking advantage of that is getting your fill price as close to the open of the day as possible.

In order to do that, consider using MOO (market on open) orders. The open of the market at 9:30 is actually the result of an auction. All orders submitted before 9:28 go into a pool for each stock. If there is an imbalance of orders for market open, that is where market makers will come in and provide liquidity. However, note that for this method there is no guarantee that you get a good price. The stock could see a lot of initial buyers, and then quickly drop off after 9:30. However, by using this method you will come much closer to the listed “open” of a stock.

If you want to read more, check this out on Investopedia:

https://www.investopedia.com/terms/m/marketonopen-order-moo.asp

I actually use this order in my trading utilizing interactive brokers (not affiliated in any way) https://www.interactivebrokers.com/en/trading/orders/moo.php

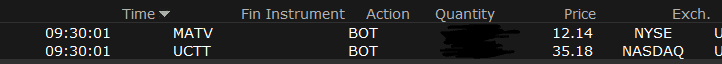

For example, for the recent alerts on UCTT and MATV you can see the opening prices that I got. If you look at Yahoo finance, the prices are the same for opening for MATV, meaning I didn’t worry about spread, I just got in on the open.

Hope this helps!

– The team at Insider Trading Alerts