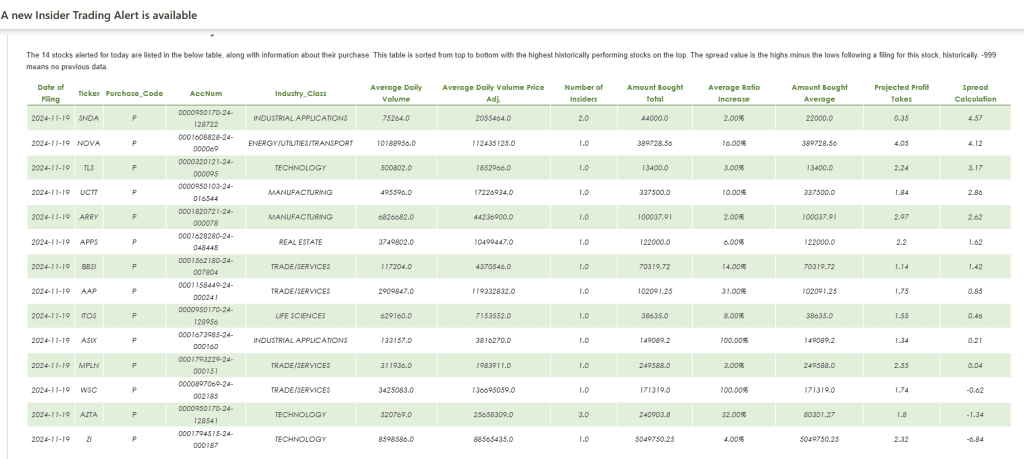

So last night, a new set of alerts came out, and there were a lot. Insiders are buying a lot right now since we are between earnings seasons. This way, their purchases don’t get misconstrued as being based on material non public information the SEC could prosecute them for. As you can see, there are around a dozen notable transactions. So how do we only trade on the ones we really care about?

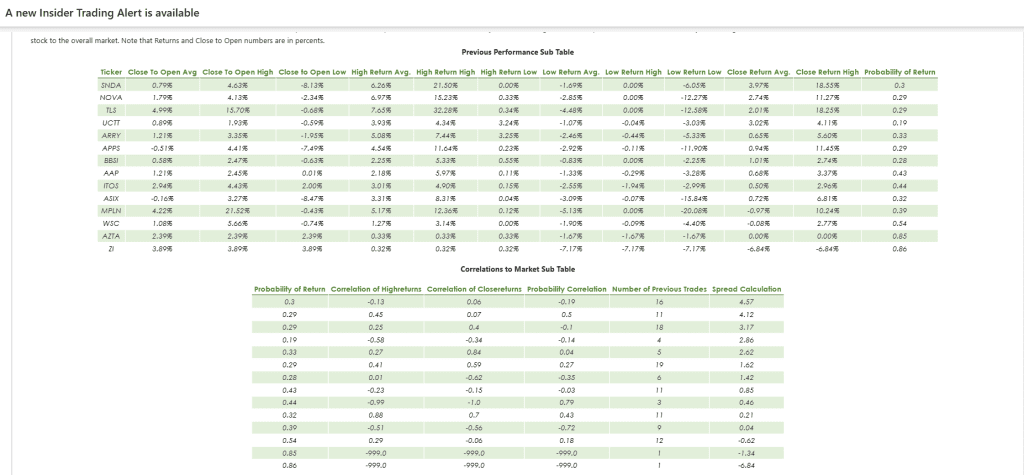

The first thing we do is look at the Spread Calculation number – why is that? Because spread calculation is AVG HIGH – AVG LOW the day after an insider trade. Meaning the higher this number, the more historically well the stock has done after an insider trade filing. So in this case, we notice that this table is sorted by this number, so lets look at the top 5 stocks. – SNDA, NOVA, TLS, UCTT. We can look at the next table in the email and note: How often does this occur? Have there been a lot of transactions? What’s the average high that the stock reaches? Below is that next table in the email.

As we can see, there were a lot of previous trades for each of these stocks. In fact, we notice that the average high return for the top 5 is around 5% for each. This historical data, including looking at the lows can allow us to set profit takes and stop losses.

In this case then, we would think that any of these top 5 would be a good bet. We can also note that generally, you want to focus on stocks with a POSITIVE spread calculation.

So, let’s see how those stocks did on the day of 11/20/2024

SNDA +7%

NOVA +23% (yes, twenty three percent)

TLS + 1%

UCTT +6%

ARRY +4%

NOVA alert timing example:

And this is all on a day where SPY is trading sideways, opening and closing at the same price. If you want to follow these alerts, be sure to sign up. Otherwise, keep reading for more informational posts!